, but I would still keep my Fiat collection because it provides fun which cannot be measurable

, but I would still keep my Fiat collection because it provides fun which cannot be measurable

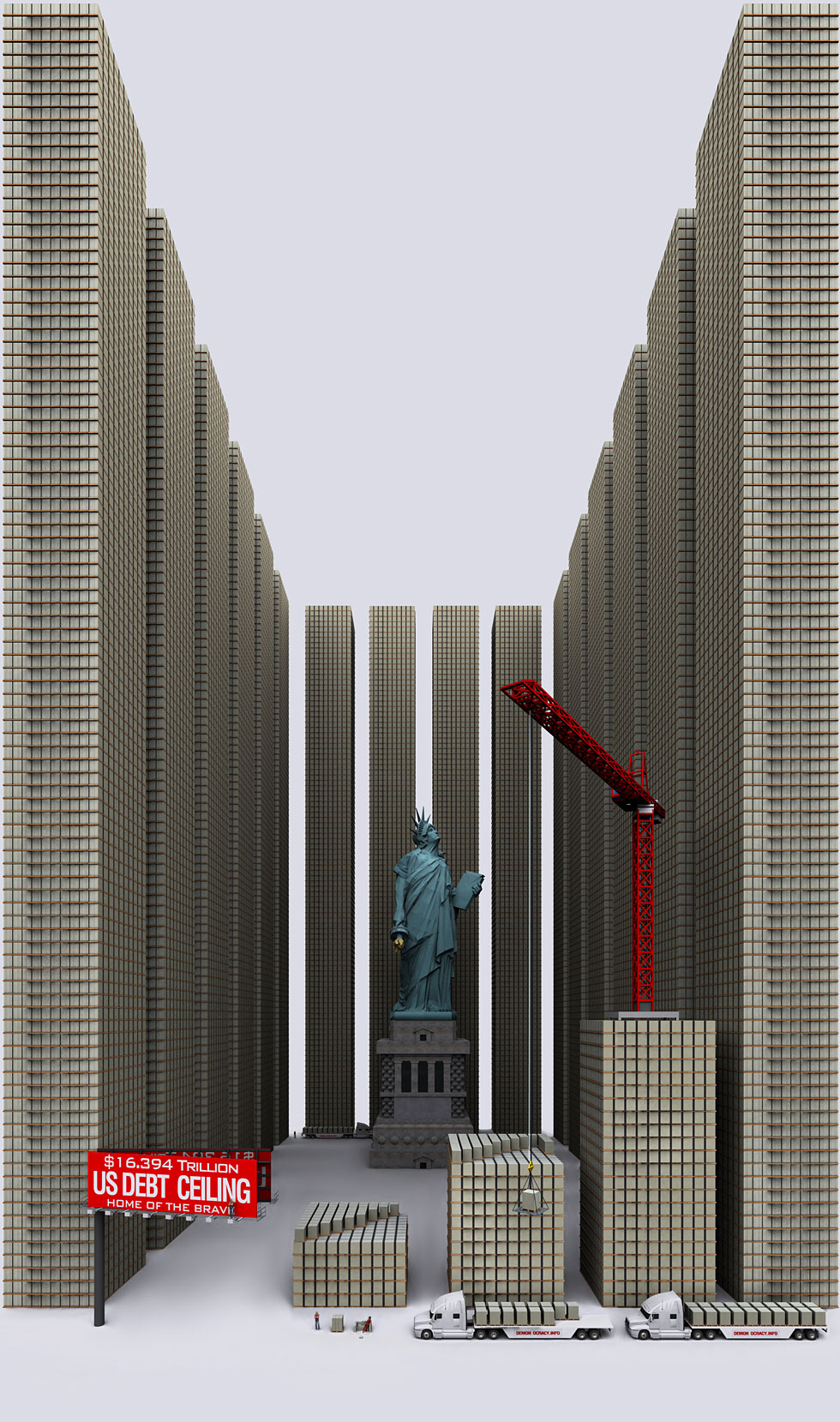

"What has been beginning to spook Moody's and some other people is that Congress may be dumb enough to actually default on the debt," said Cliff Draughn, chief investment officer of Excelsia Investment Advisors in Savannah, Georgia.

國際貨幣基金組織(IMF)昨發表報告,強烈警告本港樓價已比08年國際金融風暴的谷底抽升一倍,樓市是拖垮本港經濟的主要風險,美國一加息,樓價就會大瀉,並引發骨牌效應,負資產再現。

IMF今年的香港評估報告,於上月中撰寫。報告首章便是本港物業情況,指出去年首10個月,樓價已累積上升23%;相比08年谷底,升幅更已達一倍。IMF歸咎多年來私樓單位供應持續偏少,平均只有9,700個,未及目標一半,內地買家來港入市也是主因。

恐負資產再現

報告引述最新全球住房負擔報告發現,香港樓價中位數已達家庭年收入中位數的12.6倍,冠絕全球。以1,200平方呎的豪宅售價比較,去年本港平均呎價僅次於倫敦,高過東京、新加坡及紐約。

IMF指出,本港物業貸款佔貸款市場一半,樓宇又是借貸抵押品,樓價一旦急挫,抵押品價值下跌,將出現負資產,繼而對本地需求、銀行貸款和物業市場產生連鎖反應。IMF表示,利率自00年開始下跌至今,美國利率最終會回升,在聯繫滙率機制下本港也跟隨上升,將加劇樓市調整。

港府去年10月增設境外買家印花稅和增加額外印花稅,IMF報告再肯定這點,並提出有需時可加推其他措施。IMF強調,港府需要保障銀行體系穩定。

梁振英在施政報告只提中長期增加土地供應。最新中原樓價指數為115.93,施政報告公佈前一周,樓價再升0.28%。

房產發展研究中心研究員姚松炎指,香港樓宇價格近幾年急升,與負利率不無關係,造成資產泡沫,今次國際貨幣基金組織只是再一次肯定該理論。他又表示,國際貨幣基金組織多年來都熟悉美國利率是人為操控,「所以你去估佢幾時加息係冇意思嘅」。他又指,美國加息與否從來不會考慮國際經濟狀況,「佢從來冇保證幾時會加,所以突然開咗會就話加息都得,唔使同邊個負責。」

| 歡迎光臨 香港快意討論區 (http://forum.hkfiatclub.com/) | Powered by Discuz! 7.2 |